Ponzi Schemes in Web3 --- Swamps in the Dark

A guide on how to stay safe when interacting with DeFi projects

Disclaimer

The information provided through HashDit does not constitute advice or recommendations for investment or trading. HashDit is not responsible for any of your investment decisions. Please seek professional advice before taking financial risks.

What's a "ponzi"?

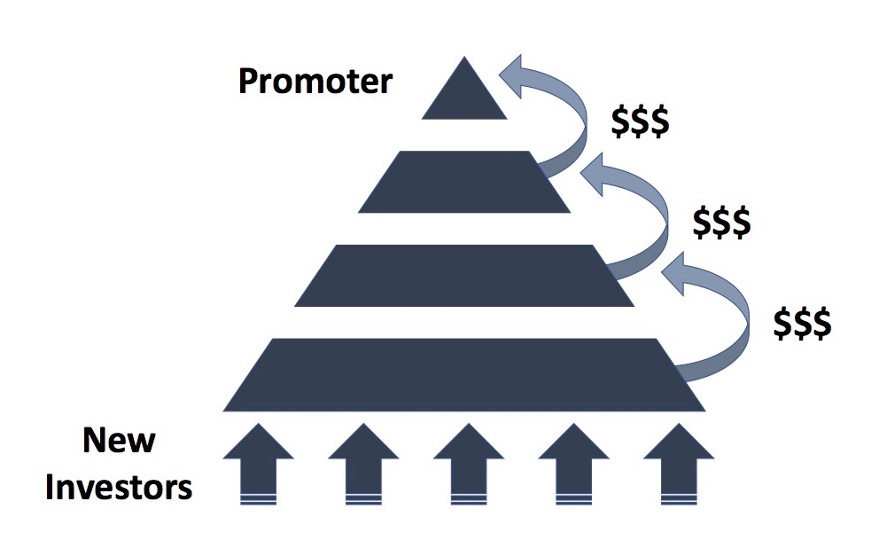

According to Wikipedia, the Ponzi scheme is a form of fraud that lures new investors and pays profits to earlier investors with funds from more recent investors. As you can imagine, if recent investors pay to earlier investors then... who pays the recent investors? The answer is, the even more recent investors. And if there are no more recent investors, then the latest ones remain with a loss, and the scheme collapses.

The ponzi scheme is often referred to as pyramid scheme, because to pay the "higher floor" investors with a profit, a larger, "lower floor" has to be created, like in the picture below.

https://sperrinlaw.net/financial-crime-fraud/ponzi-fraud/

Since the pyramid is not a real business, in terms of creating a product or a service and leveraging it to earn money on the market, in order to keep the funds flowing in, new investors have to be recruited and their "investment" is used to pay the old investors, who can then report significant returns on their investments. This creates an illusion of a profitable business, at least as long, as the current "lowest floor" manages to recruit new members.

If that's so obvious, then why people keep falling for it? Usually, the ponzi schemes are disguised as legitimate investments or projects. They will do everything to hide it's true nature so the new coming investors will believe they just met an investment of their lifetime. And when the scheme falls, it's already too late to run away.

Are there ponzi schemes in web3? If so, how to spot them? How not to lose money? Read on to learn more!

Ponzi schemes in Web3

Although Ponzi schemes originated in the traditional financial world, with the development of DeFi (Decentralized Finance), these fraudulent business models have also started to emerge in Web3. Web3 Ponzi schemes take advantage of the following features of DeFi, attracting investors through high returns and incentives.

Anonymity: The decentralized nature of DeFi allows Ponzi scheme operators to remain anonymous, making it difficult to trace and hold them accountable.

Utilizing smart contracts: A smart contract is a self-executing, self-enforcing protocol governed by its explicit terms and conditions. It stores and carries out contractual clauses via blockchain. These schemes use smart contracts to automate their operations, making them harder to detect while promising high returns on investments.

Tokenization: Some Ponzi schemes create their own tokens and use them for fundraising. They offer high rewards in the form of tokens, which may have little to no real value.

Limited regulation: The DeFi space has limited regulation, making it easier for Ponzi schemes to operate without being detected or shut down by financial authorities.

Low cost: Ponzi scheme projects can be fully autonomous and deployed at lower costs. They can even be continuously cloned.

So, how can one identify if a Web3 DeFi project is a Ponzi scheme or not?

Firstly, let's look at the project characteristics. Ponzi schemes usually have the following features:

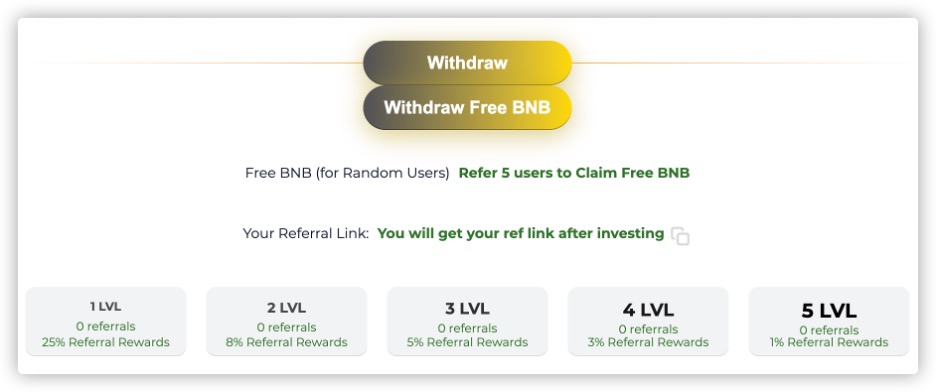

Typical Web3 Ponzi schemes often employ aggressive marketing tactics, promising high and fixed short-term returns. For example, the official websites of such projects usually contain descriptions like "fixed daily profit". However, we know that fixed daily returns are unrealistic, and this is one of the biggest flaws in Ponzi schemes. In the cases we've accumulated, some Ponzi projects have even promised 25% daily interest rates!

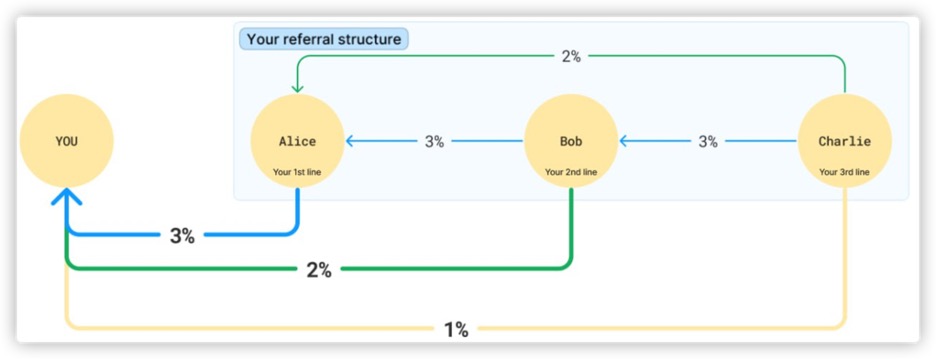

High Referral Incentives: Ponzi schemes often combine with pyramid scheme marketing, aiming to attract more new investors and subsequent investment funds. Therefore, they often advertise a referral reward system on their official websites, sometimes even with multi-level referral rewards. Typical pyramid scheme descriptions include terms like "tiered referral rewards." The two images below are tiered referral reward system diagrams taken from Ponzi scheme websites:

- These schemes usually disguise themselves as staking or mining projects to attract investors' principal investments and recruit new participants. However, in fact, they generally do not offer any real products or services but just promise an ability to make money. They often incorporate some popular trends, for example, AI or ChatGPT, promoting their projects as groundbreaking and innovative, as they need to attract more people and maintain an appearance of legitimacy.

Below are some additional features that can help investors determine whether a project is a Ponzi scheme. Please note that these traits are not exclusive to Ponzi scheme projects. Generally, the more of these a project has, the higher the risk:

No proper investments: The project appears to have no investments or partnerships, which means that the project lacks any business endorsements.

Opaque team information: The team behind the project remains anonymous to the public, making it easier for such projects to engage in malicious activities with lower costs.

Lack of documentation: There is a lack of documentation and whitepapers, as the project does not provide details about its internal operations and how it achieves these high returns. This is a potential red flag.

No external audit report: Projects with audit reports generally have a relatively smaller chance of encountering security issues. However, please note that having an audit report does not guarantee absolute security, as the audit report may only cover certain contracts and not examine the entire economic ecosystem of the project. The reliability of the audit report is also important, depending on the issuer and quality; well-known and reputable audit companies usually have greater credibility.

Decrypting a Ponzi project smart contract

Are you a more tech-savvy user? That's great. If you have some familiarity with Solidity code or want to learn it, we encourage you to go through the code snippets below to understand some of the characteristics of Ponzi scheme smart contracts.

As we mentioned earlier, Ponzi scheme Web3 projects generally don't have any real products, and therefore don't require many smart contracts. In their entire project ecosystem, there are usually only a few investment contracts that directly interact with users. At most, there might be an additional token contract, with the token often serving as a staking reward. However, this token typically won't be created on any decentralized exchange (DEX), meaning that holders of this token cannot swap it for other valuable tokens or stablecoins.

Next, we will delve into the characteristics of Ponzi investment smart contracts by using some code snippets as examples.

There is no method in the contract to withdraw the initial investment; it only allows for receiving dividends based on time

For example, in the below withdraw function, users cannot withdraw their principal investment; they can only withdraw dividends along with potential referral earnings.

This is also the difference between Ponzi schemes and regular mining/staking contracts.

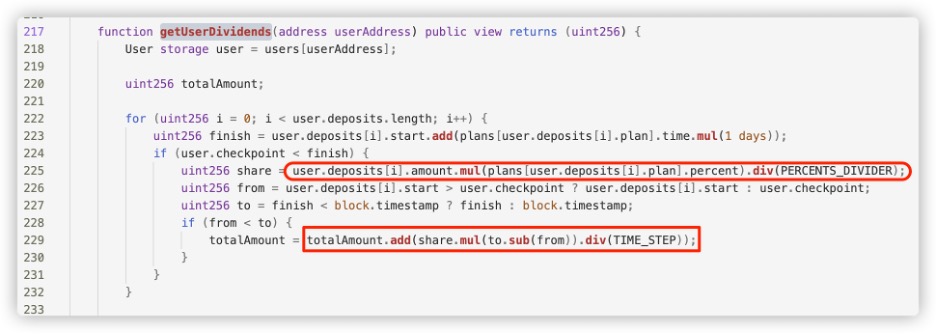

Dividends are calculated based on a fixed daily returns ROI and time. For example, in the getUserDividends function below, the user's dividend is calculated by multiplying the fixed daily return rate for the user's deposit plan by the time elapsed. Typically, the daily return ROI is a hard-coded value or constant.

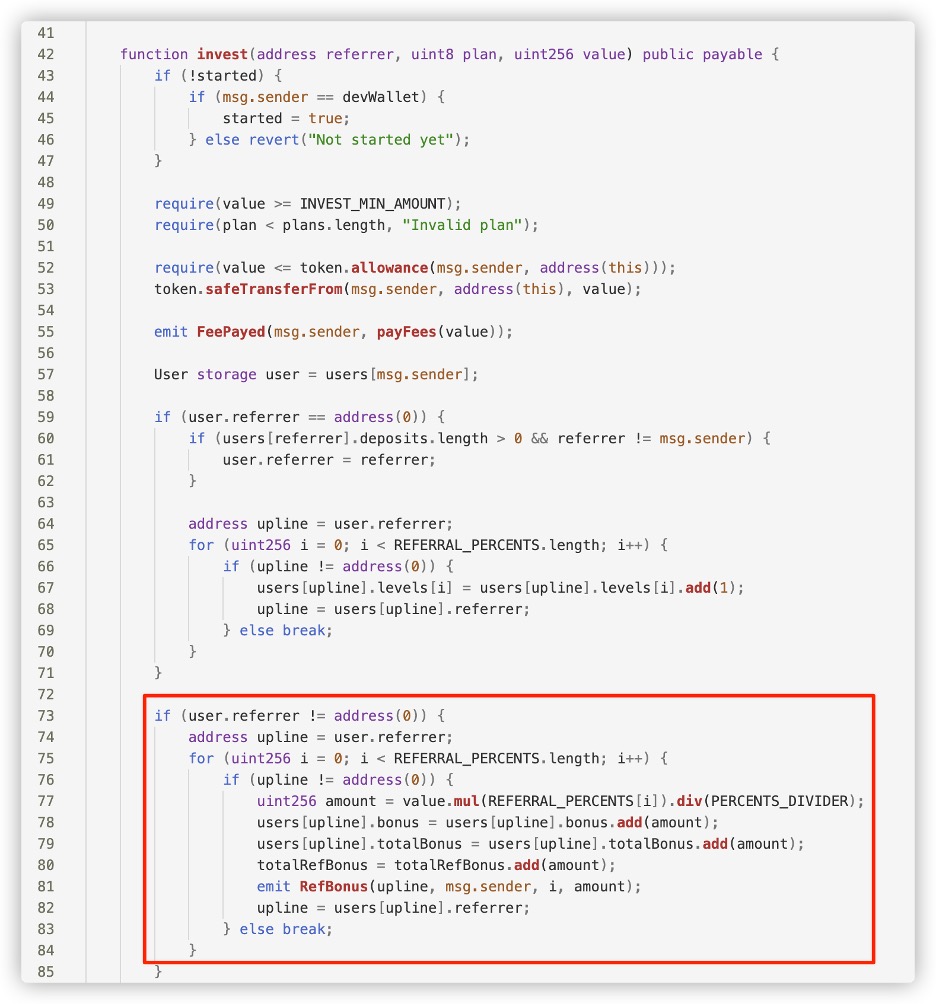

The code contains logic related to a Referral system. As we mentioned earlier, Ponzi investment smart contracts usually include a referral system, providing users with additional incentives for bringing new users into the scheme.

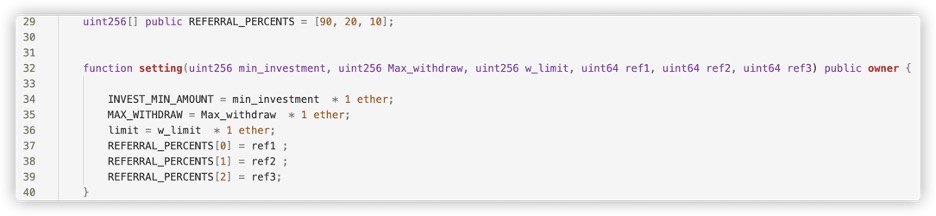

For example, in the contract below, there is a tiered referral reward mechanism, with first, second, and third-level referrers receiving referral rewards at a ratio of 9:2:1.

Of course, the referral rewards come from the principal investment of later investors. As can be seen, the invest function in the code distributes part of the user's investment amount to all referrers at their respective levels.

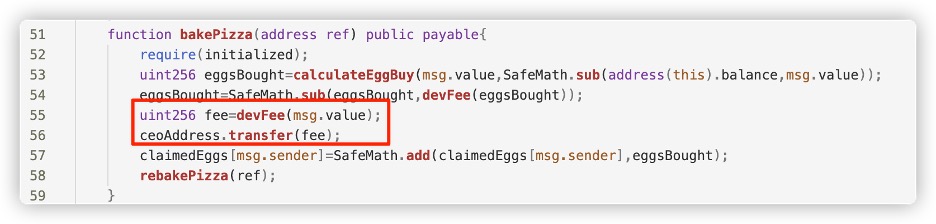

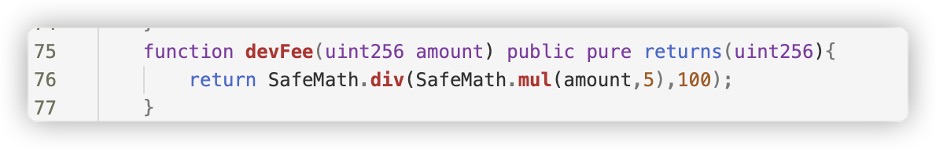

The project party generates revenue by charging tax fees on users' deposits. For example, in the code below, the project party charges a 5% dev fee on the user's principal, so they can profit as long as there are new users, regardless of how much money remains in the pool.

However, sometimes the project party does not directly impose a tax fee, claiming to have a 0% tax fee. In reality, the project party can become the initial referrer and continuously profit through the referral mechanism. This method of profiting is just more concealed.

Go further: A complete Ponzi example for more tech-savvy users

Let's go further! we created a sample ponzi scheme code based on what we're finding during our everyday work. We encourage you to study below simple smart contract code.

pragma solidity ^0.8.0;

contract PonziScheme {

address public owner;

mapping(address => uint) public investments;

mapping(address => uint) public recruits;

mapping(address => uint) public investmentTimestamp;

constructor() {

owner = msg.sender;

}

function recruitAndInvest(address referralAddress) public payable {

require(msg.sender != referralAddress, "Cannot refer yourself");

require(investments[msg.sender] == 0, "Already invested");

require(msg.value == 0.1 ether, "Investment should be 0.1 Ether for recruitment bonus");

// Add the recruit count for the referrer

recruits[referralAddress]++;

// Add the investment for the new investor with the bonus

investments[msg.sender] = msg.value + 0.1 ether; // 0.1 ether bonus

investmentTimestamp[msg.sender] = block.timestamp;

}

function calculateTotalReturn(address investor) public view returns(uint) {

uint numberOfRecruits = recruits[investor];

uint baseInvestment = investments[investor];

uint profit = 0;

if (numberOfRecruits >= 10) {

profit = baseInvestment * 50 / 100; // 50% ROI

} else if (numberOfRecruits >= 5) {

profit = baseInvestment * 25 / 100; // 25% ROI

}

return baseInvestment + profit; // Total return = initial investment + profit

}

function cashOut() public {

uint totalReturn = calculateTotalReturn(msg.sender);

if (totalReturn == investments[msg.sender]) {

require(block.timestamp >= investmentTimestamp[msg.sender] + 90 days, "Minimum 90 days required to withdraw without recruits");

}

require(address(this).balance >= totalReturn, "Insufficient funds in the contract");

msg.sender.transfer(totalReturn);

investments[msg.sender] = 0;

recruits[msg.sender] = 0;

}

}

Entry Point: The entry point for new investors is the recruitAndInvest() function. Here, a new investor specifies a referral address (the person who introduced them to the scheme) and sends 0.1 ether as their investment.

Incentive to Recruit: The incentive to recruit new members is twofold: Frist, the referrer gets a count increase in their recruits mapping, which will later increase their ROI. Second, the new investor gets a bonus of 0.1 ether added to their investment, effectively doubling their initial investment.

Ponzi Mechanics: The Ponzi nature of the scheme is visible in the calculateTotalReturn function. The ROI is determined by the number of recruits: 5-9 recruits: 25% ROI 10 or more recruits: 50% ROI The more people an investor recruits, the higher their promised return.

Potential Collapse: The scheme can collapse at some point. The ability to withdraw funds is implemented in the cashOut() function. If the contract doesn't have enough funds to pay out the total return (initial investment + profit), the cash out will fail. This will happen if not enough new investors are coming in to fund the returns for earlier investors. The require(address(this).balance >= totalReturn, "Insufficient funds in the contract"); line checks for this.

Safety Net (or Illusion of One): If an investor hasn't recruited at least 5 people, they can only withdraw their initial investment after 90 days. This might give the illusion of safety and legitimacy, but it's just a delay tactic. During the 90 days, the scheme might already rise and fall, and when the time for withdrawal comes, there might already be no funds on the contract.

Now you have a deeper understanding of the contract code for Ponzi schemes. However, in reality, some Ponzi smart contracts are even closed-source, making them opaque and more difficult to analyze and understand, thereby concealing the contract's logic and risks from users. When dealing with closed-source contracts, we should maintain an even higher level of vigilance and examine both the project and contract levels comprehensively to determine if they exhibit characteristics of a Ponzi scheme.

Identifying Ponzi schemes in a more simple way

In summary, before investing in Web3 DeFi projects, you need to conduct thorough due diligence to avoid mistakenly entering Ponzi schemes and incurring losses.

At the project level, conduct comprehensive research on the project team, token economy, and underlying technology. Be cautious of unrealistic high return promises, ensure that there is adequate transparency in the project, and verify that the project has a sound governance mechanism.

At the smart contract level, fully understand the source code and determine if there are any red flags in the code, always assessing risks before gaining a deeper understanding.

However, is this too complicated and difficult? After all, not all investors are technical experts. Don't worry, HashDit can help you.

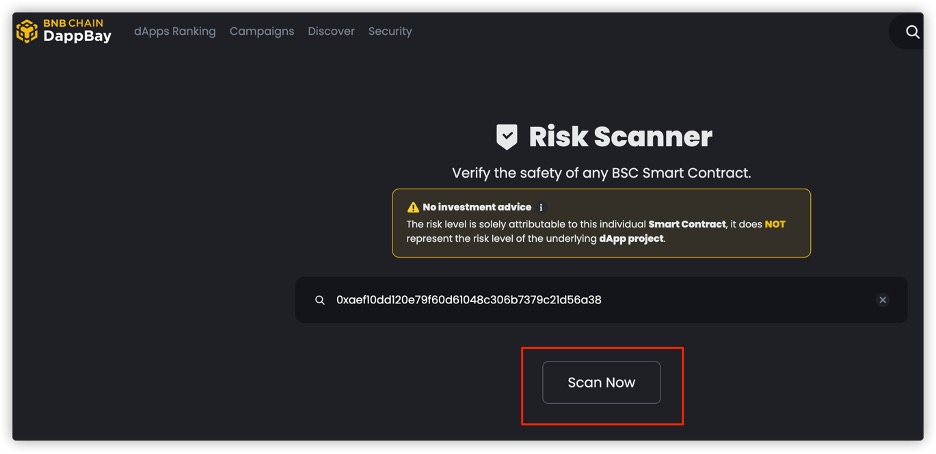

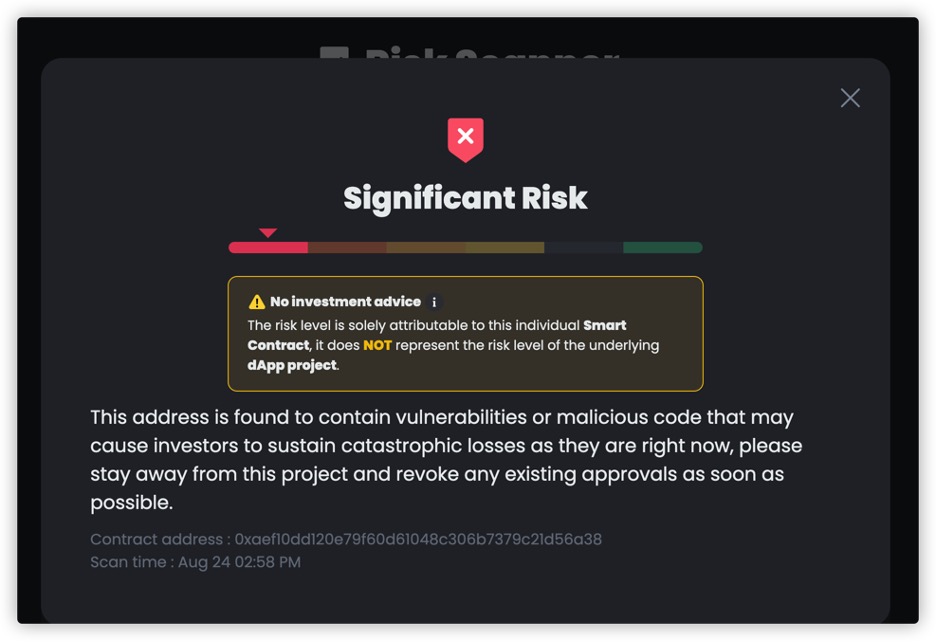

For smart contracts, you can scan whether it is a Ponzi contract through https://dappbay.bnbchain.org/risk-scanner using the contract address. Dappbay's scanner is technically supported by HashDit, which has integrated various recognition rules for Ponzi schemes.

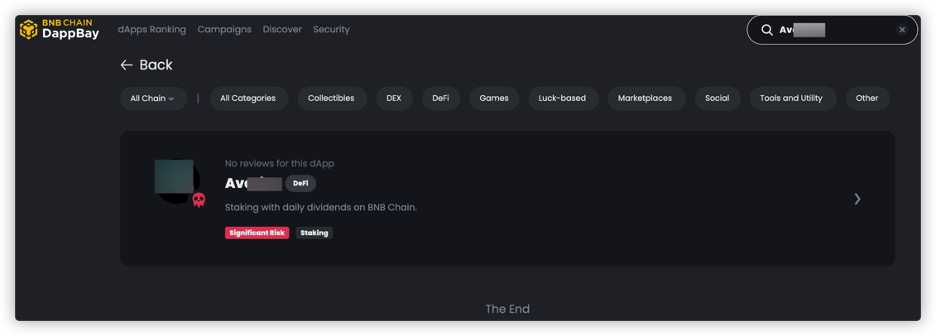

You can also search on the Dappbay website (https://dappbay.bnbchain.org/r) based on the Dapp's name, Twitter, website, etc., to see if the project has been marked as significant risk.

Additionally, you can follow HashDit's X (https://twitter.com/HashDit). HashDit continuously monitors data on the BNB chain and provides ongoing alerts for BNB chain-related risks.

Remember, never invest blindly in the dark forest of Web3. HashDit will guide you around every "swamp" and protect your Web3 journey!

Appendix

Below are some Ponzi scam Web3 projects that HashDit has identified in the past. Please stay alert! At the same time, you can also use these projects as reference materials to conduct your own research!

(Scroll right on the form below for more information)

| Chain_id | Address | Website | Project Name | Risk Reason Remark |

|---|---|---|---|---|

| 56 | 0x3f3f162e8F172fB681a4Fe9BE187B0FF21fE0734 | avaricetoken.io | Avarice | Ponzi Scam Project |

| 56 | bnbdaily.finance | BNB Daily Finance | Ponzi project - Offers unsustainable rates of "DAILY ROI 0.7%". Lack of investments, product, documentation. Opaque team. | |

| 56 | 0x3471Cc34ED5d7ceadd0a533dedA18ecC0d6Bd927 | cashbox.cfd | Cashbox Investment Pool | High APR/APY. Lack of investments, product, documentation. Opaque team. |

| 56 | finx.global | FinSwap | High APR/APY. Centralization in top holders. | |

| 56 | busdyield.com | BUSDYield | Ponzi SCAM Project | |

| 56 | twitter.com/x_roi_community | TrueFund | Ponzi scam Project | |

| 56 | bnbcrush.io | BNB Crush | Ponzi scam Project | |

| 56 | ai-trader.app | AI Trader | Ponzi scam Project | |

| 56 | chronostake.com | ChronoStake | Ponzi scam Project | |

| 56 | rewardscapital.app | Reward Capital | Ponzi SCAM Project | |

| 56 | sharkbnb.cloud | Shark BNB | Ponzi SCAM Project | |

| 56 | 0x00000065cBADeAD116136940b302F938284f2BDc | poop.fi | Poop | Ponzi SCAM Project |

| 56 | 0xa06411Af90C84fa9Ba4168CC08D8618A602826ba | staker.cafe | Staker Cafe | Ponzi SCAM Project |

| 56 | matrixpro.vip | Matrix Pro | Ponzi SCAM Project | |

| 56 | 0x80B48C38Ced124eA15a2c19684877ccE4Ab2D524 | lamon.app | Lamon App | Ponzi SCAM Project |

| 56 | fin-toch.com | FTC | Ponzi SCAM Project | |

| 56 | 0xca7Ea9003a9cA60c2adC054a379035723A7a9F49 | kingdomlegacy.io | Kingdom Legacy | Ponzi SCAM Project |

| 56 | 0xd96099403F4b47C3046A6Da11d8cAf254D806398 | towers.pizza | Pizza Tower | Ponzi SCAM Project |

| 56 | 0xd6f5ea3db32dbdc3e9866e60459788de8a2106c7 | tripfoundation.io | Trip Foundation | Ponzi SCAM Project |

| 56 | 0x40755D50d6Af0B5955a7491D6A5DA94535c26382 | snyperfund.com | Snyper Fund | Ponzi SCAM Project |

| 56 | 0xaef10dd120e79f60d61048c306b7379c21d56a38 | bakedpizza.app | Baked Pizza | Ponzi SCAM Project |

| 56 | 0x7785035610075Ec7BcD7c833B03996E866FE0072 | blockrewards.pro | Block Rewards | Ponzi SCAM Project |